Greetings everyone,

After my graduation I have started job in Lahore with Annual salary in Slab range of 500,000 to 750,000.

Frankly I am very illiterate about taxation. After working 2 year since 2015 I just stumbled upon my taxation duty as a Pakistani national.

My company started deducting the tax from my salary mentioning that it is required by banks as of some law, but me and 90% of the employees still don't know or bother whats that suppose to mean. An I'm not sure weather my tax is being paid to Gov. or is going in company's pocket.

As a national I desire to pay my taxes honestly. And I need your help and advise on this.

I have registered an account through FBR Iris portal with my CNIC.

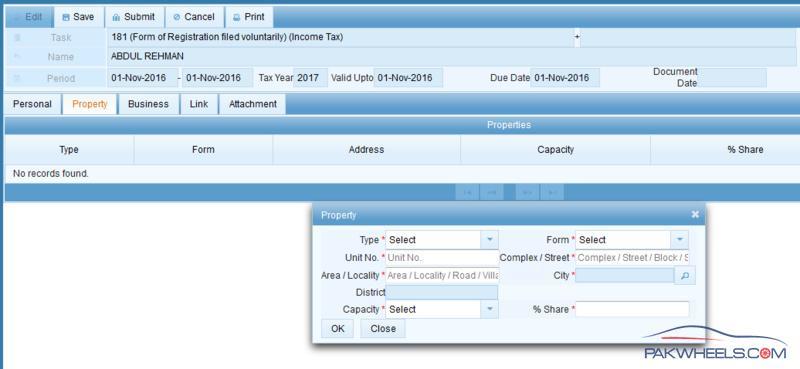

Now I'm suppose to fill the 181 form.

I'm not really good at understanding the requirements and not sure how to fill the form.

Kindly help me fill the form.

The PDF recourse given by the FBR doesn't help much, as it just says that fill the xxx fields now fill the yyy fields.

Also the form is a bit different in my case for Address Tab.

First I'm concerned about the Accounting Period dates in Personal Tab.

The Personal Tab is already filled with my accurate information and the Accounting periods are sets to 1-july to 30-june by default. Should I let the dates as it is?

In PDF help document it says that address/business fields are required.

My ID is registered on my fathers house (Gujranwala) and I live in Lahore in a rental house at the moment.

What should be filed in Property Tab?

Links Tab: It'snot very descriptive to what should be put in there, but the PDF document mentions that other properties should be mentioned here, that's what I understood. Please guide main what is required in this Tab.

I don't own any personal assets.

What is the Attachment Tab?

Do I need any documents that needs to be attached there? I read somewhere that I need proof of salary and bank certificate. Are such things required? If so what kind of document should I mention to authorities to have them.

I just read that to get the Certificate of Tax payer I need to go to the FBR office and bring some documents along.

Is that necessary when I'm registering through online FBR portal?

Kindly overlook any of my unawareness or mistake and guide me through to help a brother.

I'll really appreciate any pointers or help.

P.S. My next goal is to understand why should I pay tax, what are benefits and how should I utilize the system, how to file returns and what is required for me as a salaried employee to achieve this.

Regards