@abdulmajidqureshi sir kindly correct ur information. U r nt entitled to receive any benefit since u hv booked the car before 30 june 21. car july main deliver hone se koi farq nahi parta, ap ki time of supply ki definition previous year wali count ho gi.

main ek tax lawyer hon aur app ki posts parhi hain main ne. app law ko kisi se urdu main translate kerwa lo aur section 44 of chap 1 ki time of supply ki definition section 5 of chap 2 main insert ker ke parho:

"agar taxable supply per tax ka rate change ho jai to uss per wohi rate charge kiya jai ga jo time of supply ke waqat tha... aur app ke case main time of supply ka matlab hai payment ya product ki delivery, jo bhi pehle ho. aur app apni payment phele ker chukay hain"

agar 1 july ko time of supply ki definition change ho gai hai tu uss ka apke case per koi farq nahi parta. jis waqat apne car purchase/book ki thi uss waqat ki time of supply wali definition lago ho gi.

suzuki ki invoicing fbr se online linked hoti hai. jab bhi booking ki payment receive hoti hai wo fbr ke system main update ho jati hai aur tax return file kerna lazmi ho jata hai.

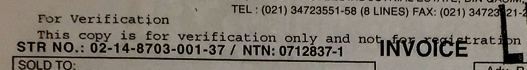

apni invoce check kero, uss main 4 pages hon ge. jis main se 2 pages verification walay hain. jab ap apni car register kerwany exicse ke pass jao ge, tu excise 4 main se 2 pages ko verification ke liye FBR ke pass behja ga aur fbr uss main se fed, with holding tax aur sales tax ko verify keray ga. ye sab cheezain check ker ke wo excise ko okay ki report bhajay ga tab ja ker apki car register honi hai.

umeed hai abb apna qeemti aur dosron ka fazool waqt waste nahi kerain ge.